Terms and Conditions

Welcome

Welcome to Honesty Tax LLC. We provide a tax preparation service to its customers. Please read the following terms of conditions. By using our service, you agree to the following and will be bound by contract. If you do not agree to these terms, please do not use our service in any way.

Signed Copy of T&C

I will need a signed copy of T&C with all three questions answered. This is (MANDATORY) before I will submit return and send refund a m o u n t .

TPG BANK

READ THIS CLOSELY!!!!!!! We use a 3rd party bank to separate my fee. The bank name is TPG Bank. This is their website (stpg.com) You can go to their site select "For Taxpayer" then "Log into TPG". There you can see your personal account number you put on your client intake form for your direct deposit. There will also be a page in the return that states this. The account number on return is an account number made solely for you by TPG Bank. It's only purpose is to collect money separate my fee and issue your direct deposit. It will come from TPG BANK.

Interview

Once I have prepared return. I will contact you to go over and discuss what I have come up with. If you need to make any changes this would be the time. After our conversation I will text you the refund amount, my fee, and what you will walk away with. Things we will discuss on the call. You must text me back and say you, agree. I will not submit the return until you respond you agree to the amount and fee.

Return

You will receive a email copy of your return FOR YOUR RECORDS ONLY. You don't need to do anything with the copy besides save it for your records. THIS IS VITAL!!!! You have 24hrs after you receive dollar amount of refund to confirm you received your email copy. I will need confirmation to let me know you received email with return and that you can view return. The return will be password protected. The password is FIRST FOUR of LAST NAME and LAST FOUR of social. All caps no spaces. After 24hrs there will be a $25 fee for me to send you a copy of return. It's important that you save your personal information. I can not send copy's every time you ask because you can't keep up with your personal information. This is why there is now a fee for this service.

Submission

Once I submit the return I CAN NOT change anything. Not your bank account. Not your dollar amount. I can't add a child. There is nothing I can do once it's accepted and acknowledged by IRS. ANY CHANGE WOULD BE AN AMENDED RETURN. Meaning a whole new return would have to be filed. And there will be a fee for that. Amendments are on a case by case basis

Tracking Return

You can track your refund on IRS app or IRS website. I wouldn't have any updated for you. You can also view your Account Transcript. You would need an IRS ID. Me account to preform this action. I can not get you this account you would have to create and register on the site yourself.

Updates on Refund

Again I wouldn't have any updates about your refund. I do not receive notices for you. If the IRS needs more information they will mail you a notice. To your address you used on your return. So please keep an eye out for mail and send me pictures just incase we need to respond. These letters are time sensitive. So this should be done sooner than later. Because I will look at date of notices and will not rush to handle your business if you don't have that same urgency.

Audit Protection

Audit Protection if not the cause by your doing. Meaning if you call the IRS and you give them misinformation, can't transcribe(tell them) what's on your return, just all out alert them an any negative way. I can't be responsible to fix what you ve created. So my advice would always be to speak with me first before calling just so YOU can be better prepared.

T/F (required)

The account number listed on your return is provided by our 3rd party bank called TPG Bank. The s o l e purpose of that account is to separate the preparers fee. Once that is done TPG will send your money direct deposited to the account you listed in the Client Portal. You can track and see your person account information on TPG's website under "For Taxpayers".

All updates about refund will only come to taxpayer(you). That can be by mail. Or from IRS website "Where's my refund". Also you can track with IRS mobile app IRS2Go. The IRS doesn't make calls to taxpayers (you). They will never call. In addition to those options you can also check for updates on your Account Transcript. You would need to have an IRS ID. Me account on IRS website. Which you would have to create yourself if you don't already have one.

If you need to call the IRS, Overtop Tax & Loans suggests you reach out to them first so that you are better prepared for any questions you may be asked on that call. If you don't follow this suggestion OTTL will not be responsible for an audit if there should be one.

Sign & Date

______________________________ ____________________

Signature Date

We’re Here to Help!

At Honesty Taxes LLC, we’re dedicated to making your tax preparation process seamless and stress-free. Have questions or need assistance? Reach out to us — we’re always ready to help!

Feel free to leave us a message using the form below.

We’ll get back to you within 24–48 hours.

Complete the Online Submission Form (Tax Help Starts Here)

and we will contact you immediately.

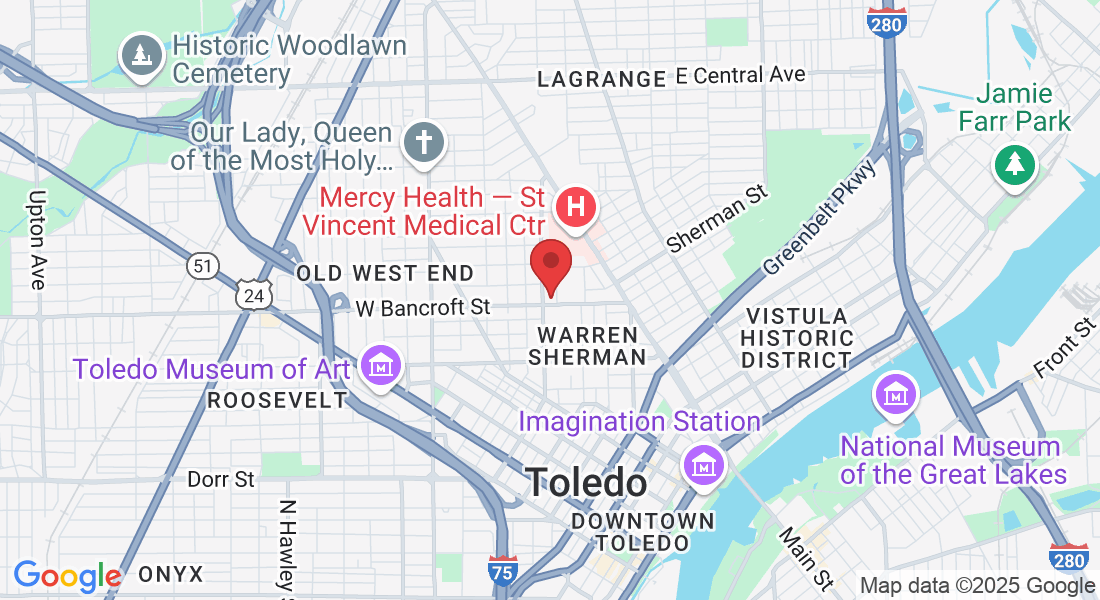

OUR LOCATION

We look forward to hearing from you!

We are open from 9:00AM-5:00PM

Monday-Fridays

1 East Bancroft Street, Toledo, OH, USA

FOLLOW US

COMPANY

CUSTOMER CARE

LEGAL

Innovation

Fresh, creative solutions.

Integrity

Honesty and transparency.

Excellence

Top-notch services.

Copyright 2025. Honesty Tax. All Rights Reserved.